Morning Star and Evening Star Candlestick Pattern Explained

The Morning Star and Evening Star candlestick patterns are powerful three-candle formations that signal potential trend reversals. Mastering these patterns can significantly enhance a trader's ability to spot turning points in the market with greater accuracy.

What are the Morning Star and Evening Star Patterns?

The Morning Star and Evening Star are opposite patterns. The Morning Star is a bullish reversal pattern that appears at the end of a downtrend, signaling a potential upward price movement. Conversely, the Evening Star is a bearish reversal pattern that forms at the end of an uptrend, indicating a potential downward price movement. Both patterns consist of three distinct candlesticks that capture a shift in market sentiment from sellers to buyers (Morning Star) or buyers to sellers (Evening Star).

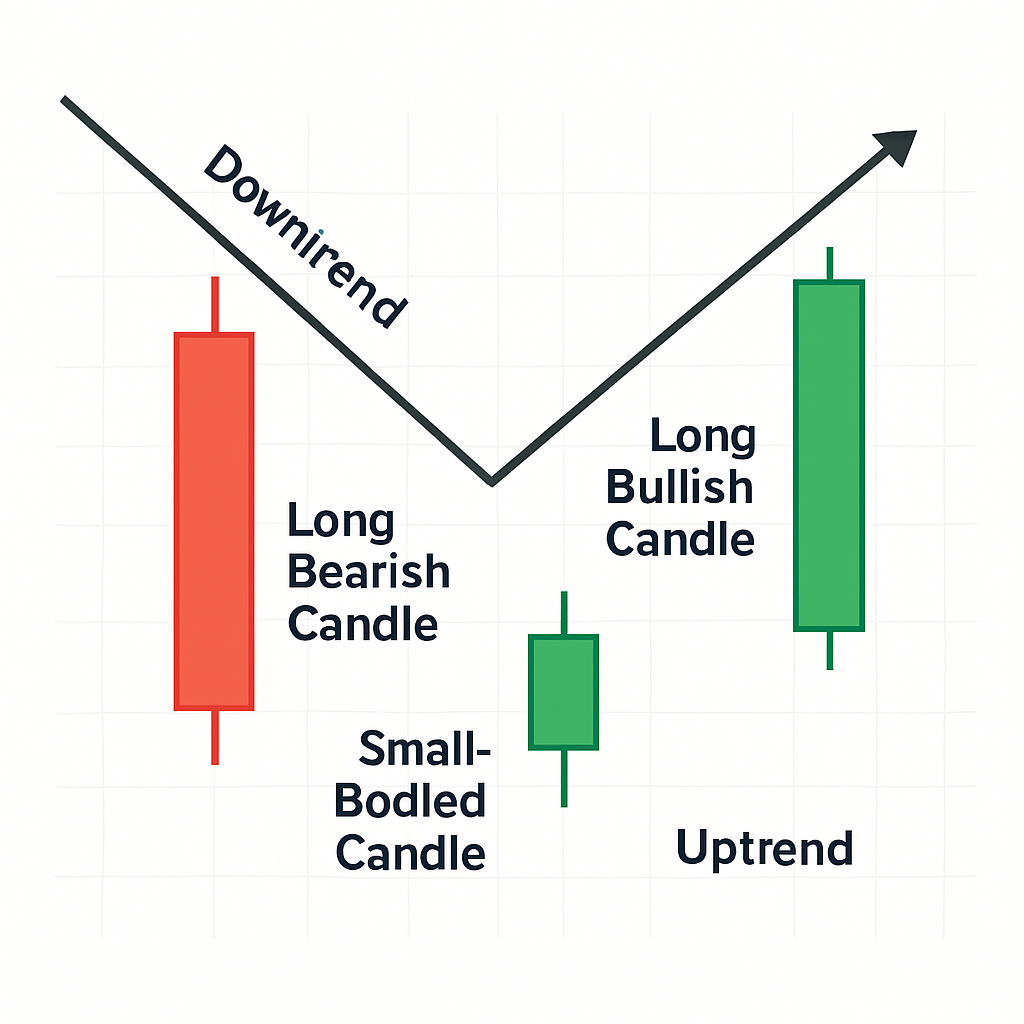

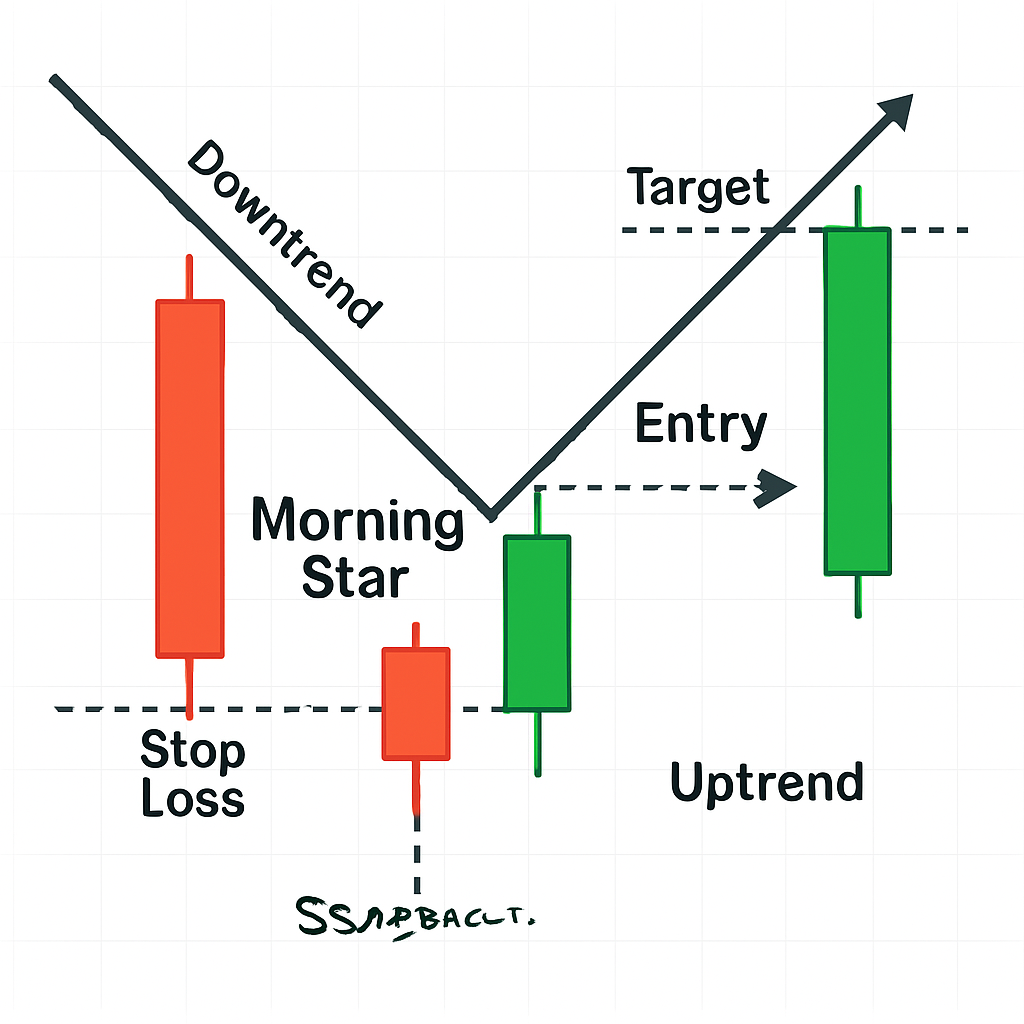

The Morning Star Pattern (Bullish Reversal)

The Morning Star pattern unfolds in a downtrend and suggests that the selling pressure is subsiding and buyers are beginning to take control. It is a visual representation of hope and a new beginning, much like the morning star (Venus) appearing before sunrise.

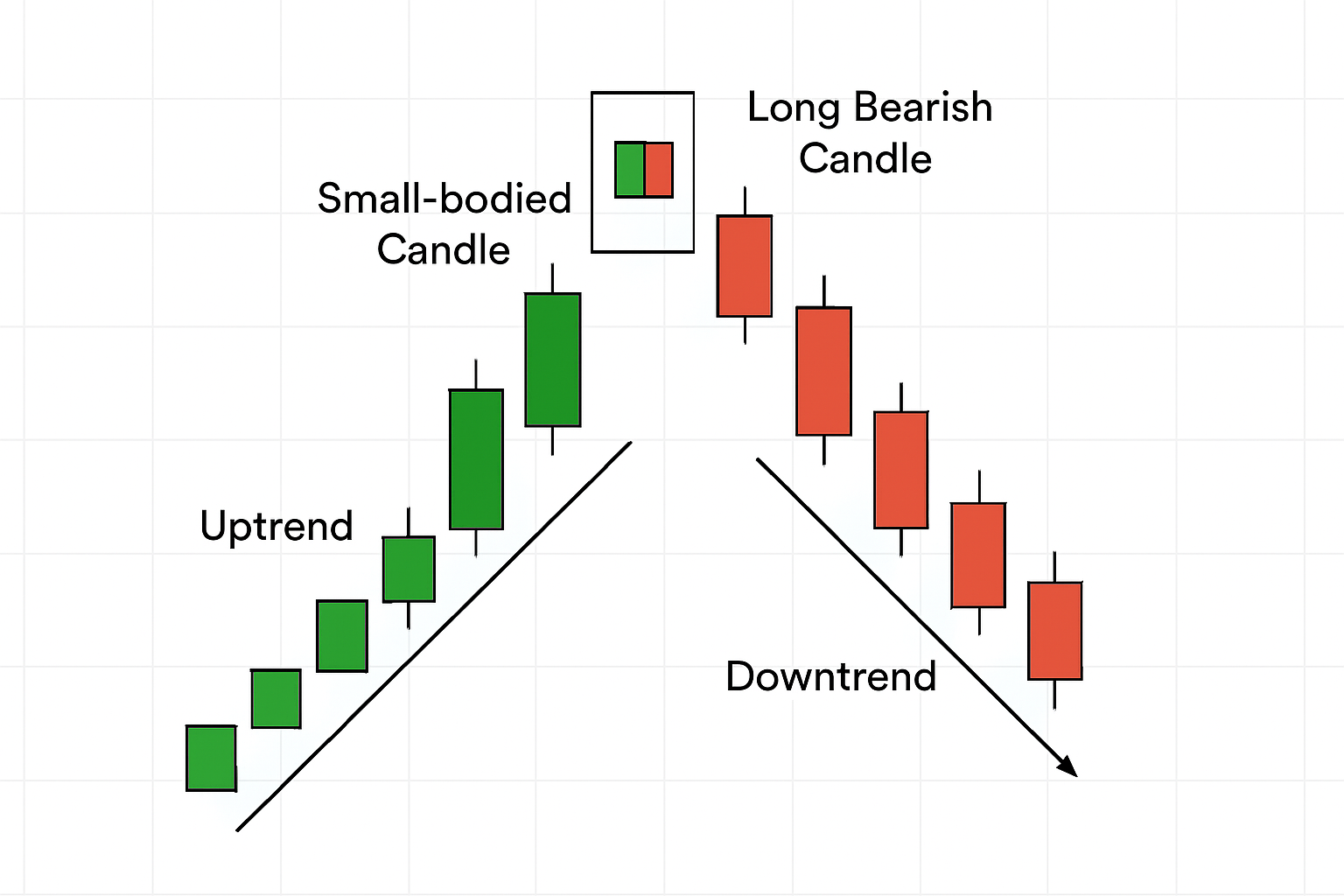

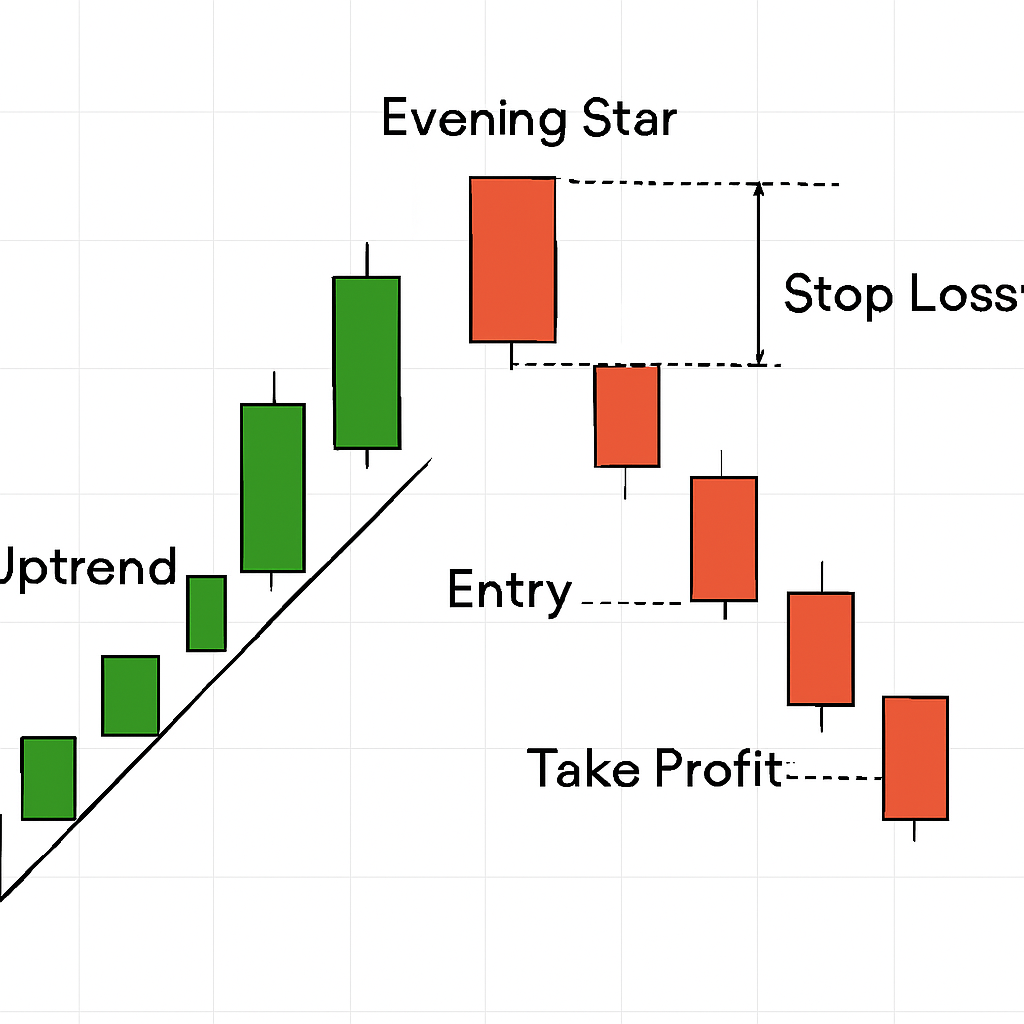

The Evening Star Pattern (Bearish Reversal)

The Evening Star pattern is the bearish counterpart to the Morning Star. It appears during an uptrend and signals that the buying momentum is fading, and sellers are starting to dominate. This pattern suggests that the "day" (uptrend) is coming to an end, and "night" (downtrend) may be approaching.

How to Identify the Morning Star and Evening Star Patterns

Accurate identification is key to successfully trading these patterns. Each pattern has specific characteristics for its three candles.

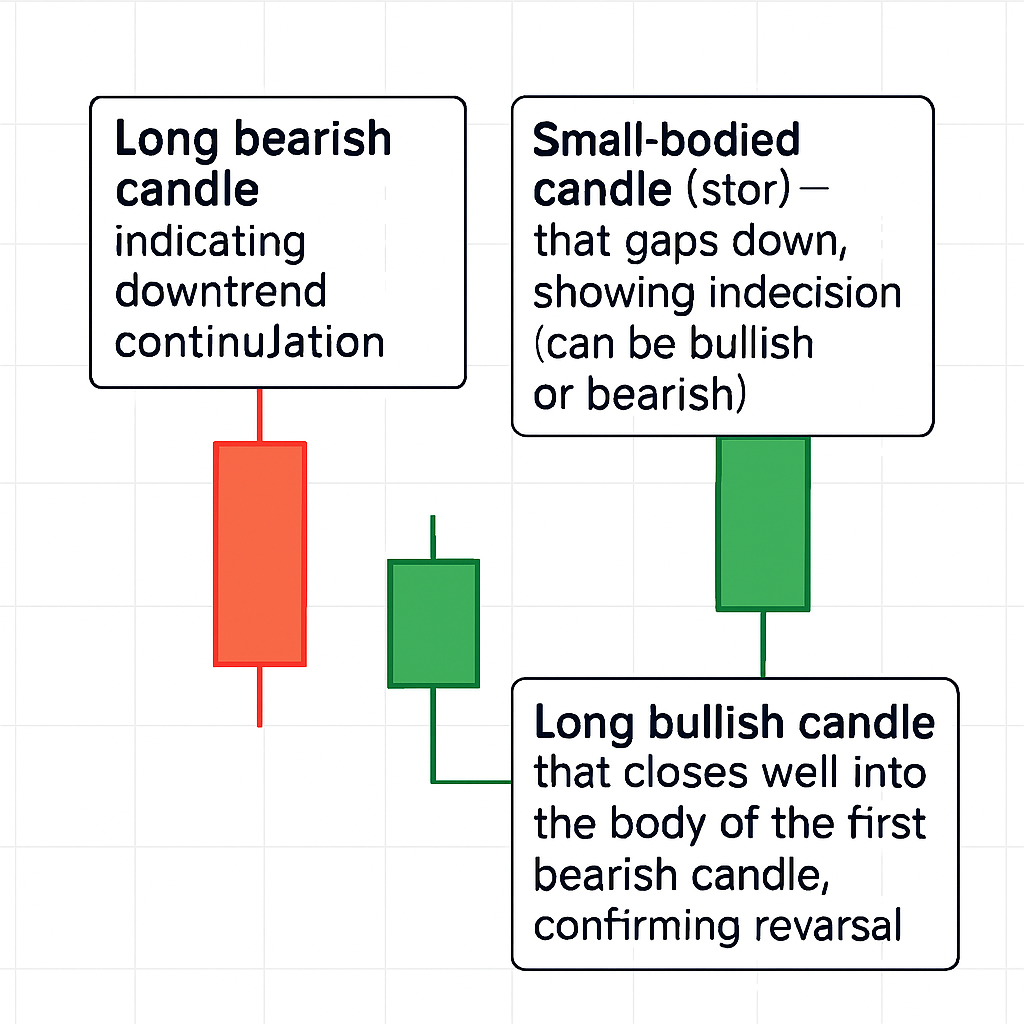

Identifying the Morning Star Pattern

To identify a Morning Star pattern, look for the following sequence of candles during a clear downtrend:

- First Candle: A long bearish (red or black) candle that confirms the continuation of the existing downtrend and strong selling pressure.

- Second Candle: A small-bodied candle (the "star"), which can be bullish (green or white) or bearish (red or black). This candle typically gaps down from the close of the first candle. The small body indicates indecision in the market, where sellers are losing control, and buyers are starting to step in. The wicks can be short or long.

- Third Candle: A long bullish (green or white) candle that closes well into the body of the first bearish candle, ideally above its midpoint. This candle signifies that buyers have gained control and a reversal is likely underway.

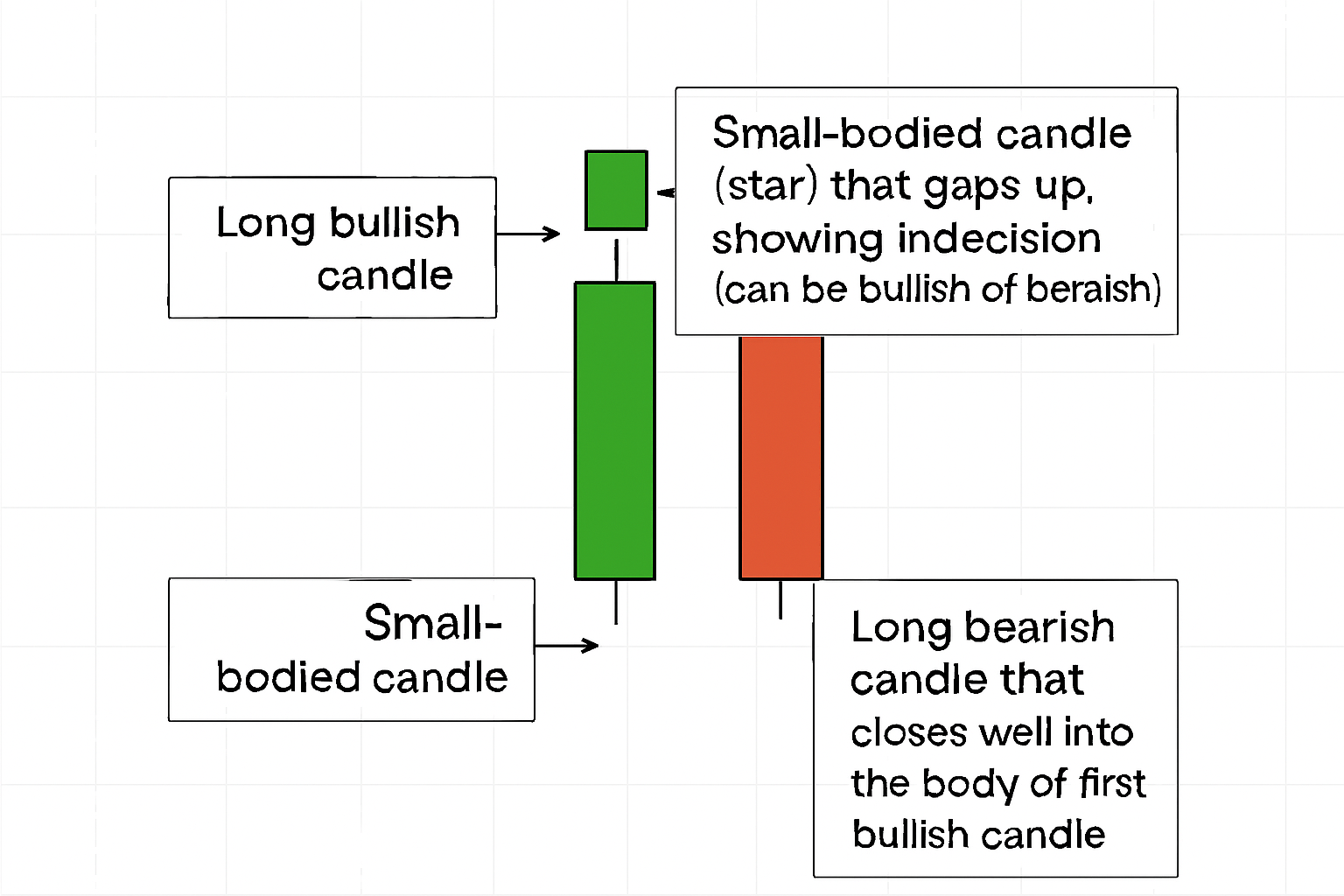

Identifying the Evening Star Pattern

To identify an Evening Star pattern, look for the following sequence of candles during a clear uptrend:

- First Candle: A long bullish (green or white) candle that confirms the continuation of the existing uptrend and strong buying pressure.

- Second Candle: A small-bodied candle (the "star"), which can be bullish or bearish. This candle typically gaps up from the close of the first candle. The small body indicates indecision, where buyers are losing momentum, and sellers are beginning to test the waters.

- Third Candle: A long bearish (red or black) candle that closes well into the body of the first bullish candle, ideally below its midpoint. This candle signifies that sellers have taken control and a reversal is likely.

How to Trade the Morning Star and Evening Star Patterns

Trading these patterns involves looking for confirmation and managing risk appropriately. While they are reliable reversal signals, it's always prudent to use them in conjunction with other technical indicators or analysis techniques.

Trading the Morning Star Pattern

Once a Morning Star pattern is identified at the end of a downtrend, traders typically consider the following:

- Entry: A common entry point is after the close of the third (bullish) candle, confirming the reversal. More aggressive traders might enter on a break above the high of the third candle or even the high of the star candle.

- Stop-Loss: A stop-loss order is usually placed below the low of the second (star) candle or below the low of the entire pattern to limit potential losses if the reversal fails.

- Take-Profit: Profit targets can be set based on previous resistance levels, Fibonacci extension levels, or a predetermined risk/reward ratio (e.g., 1:2 or 1:3).

Trading the Evening Star Pattern

When an Evening Star pattern forms at the end of an uptrend, traders consider these points:

- Entry: An entry for a short position is often taken after the close of the third (bearish) candle. More aggressive traders might enter on a break below the low of the third candle or the star candle.

- Stop-Loss: A stop-loss order is typically placed above the high of the second (star) candle or above the high of the entire pattern.

- Take-Profit: Profit targets can be identified at previous support levels, Fibonacci extension levels, or by using a favorable risk/reward ratio.

Always look for increased volume during the formation of the third candle in both patterns. Higher volume on the reversal candle adds more conviction to the pattern's validity. Also, consider the overall market context and look for confluence with other indicators like support/resistance levels, trendlines, or oscillators (e.g., RSI showing oversold for Morning Star or overbought for Evening Star).

FAQ

What is the main difference between a Morning Star and an Evening Star pattern? The Morning Star is a bullish reversal pattern appearing after a downtrend, while the Evening Star is a bearish reversal pattern appearing after an uptrend. They are mirror images signaling opposite trend changes.

Can you trade Morning Star or Evening Star patterns by themselves? While they are strong signals, it's best to use them with other indicators or analysis for confirmation. This increases the probability of a successful trade and helps filter out false signals.

Are Morning Star and Evening Star patterns reliable in all timeframes? Yes, these patterns can appear on any timeframe, from intraday charts to daily or weekly charts. However, patterns on higher timeframes are generally considered more significant and reliable.