5-0 Harmonic Pattern Explained

The 5-0 Harmonic Pattern is a unique and powerful five-point reversal pattern used in technical analysis to identify potential trend reversals. It is characterized by specific Fibonacci ratios that help traders pinpoint precise entry and exit points.

What is the 5-0 Harmonic Pattern?

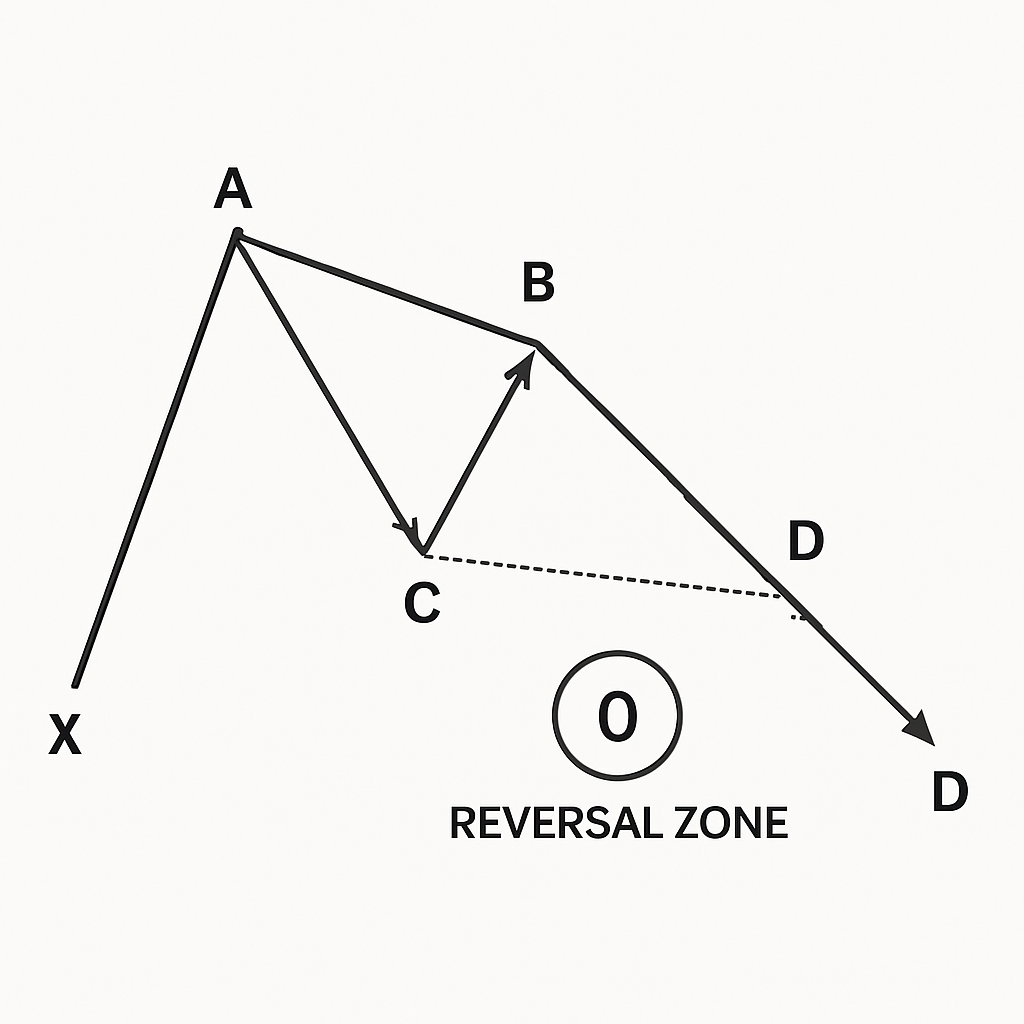

The 5-0 Harmonic Pattern is a relatively newer harmonic pattern that deviates from the traditional four-point patterns. It consists of five distinct points: X, A, B, C, and D, with the '0' point representing the completion of the pattern. This pattern is often seen as a continuation or reversal pattern, depending on its formation within the market structure.

Key Characteristics:

- Point X: The starting point of the pattern.

- Point A: The first swing high/low from X.

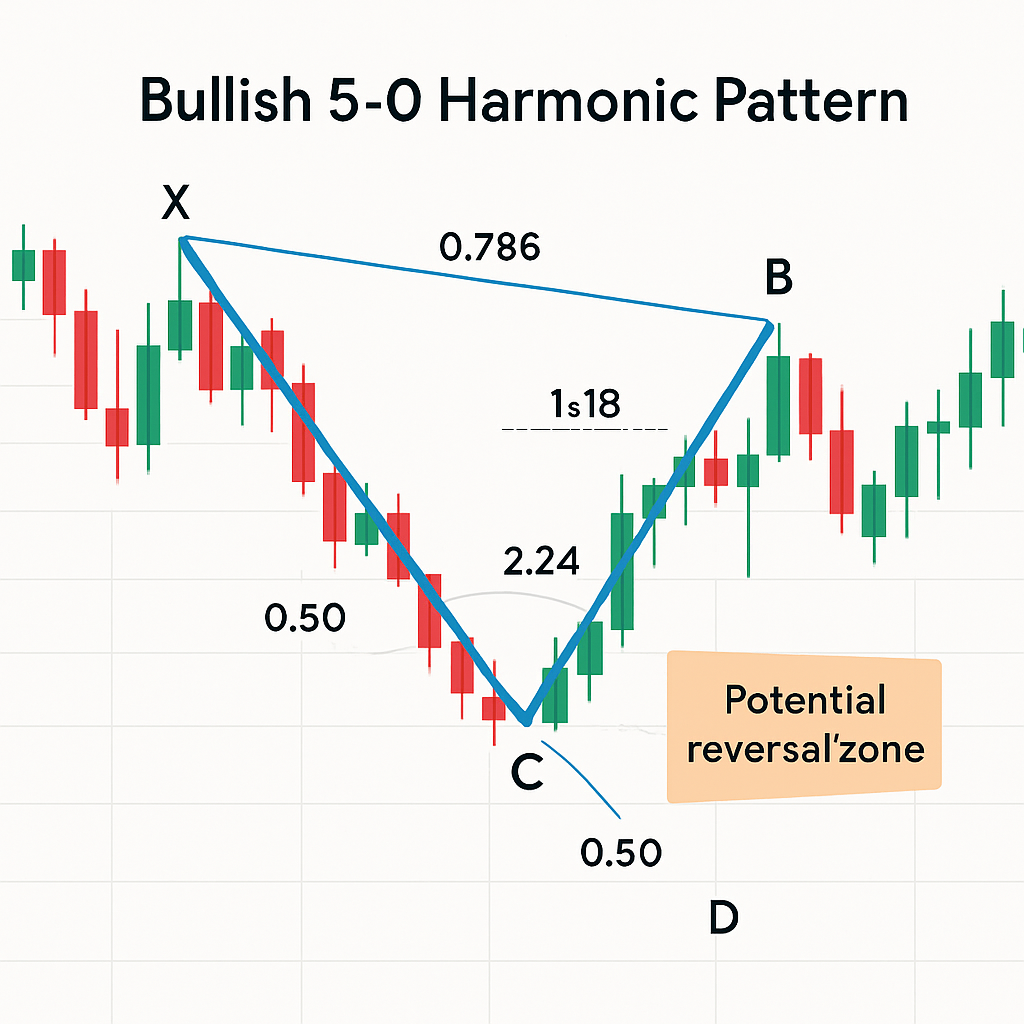

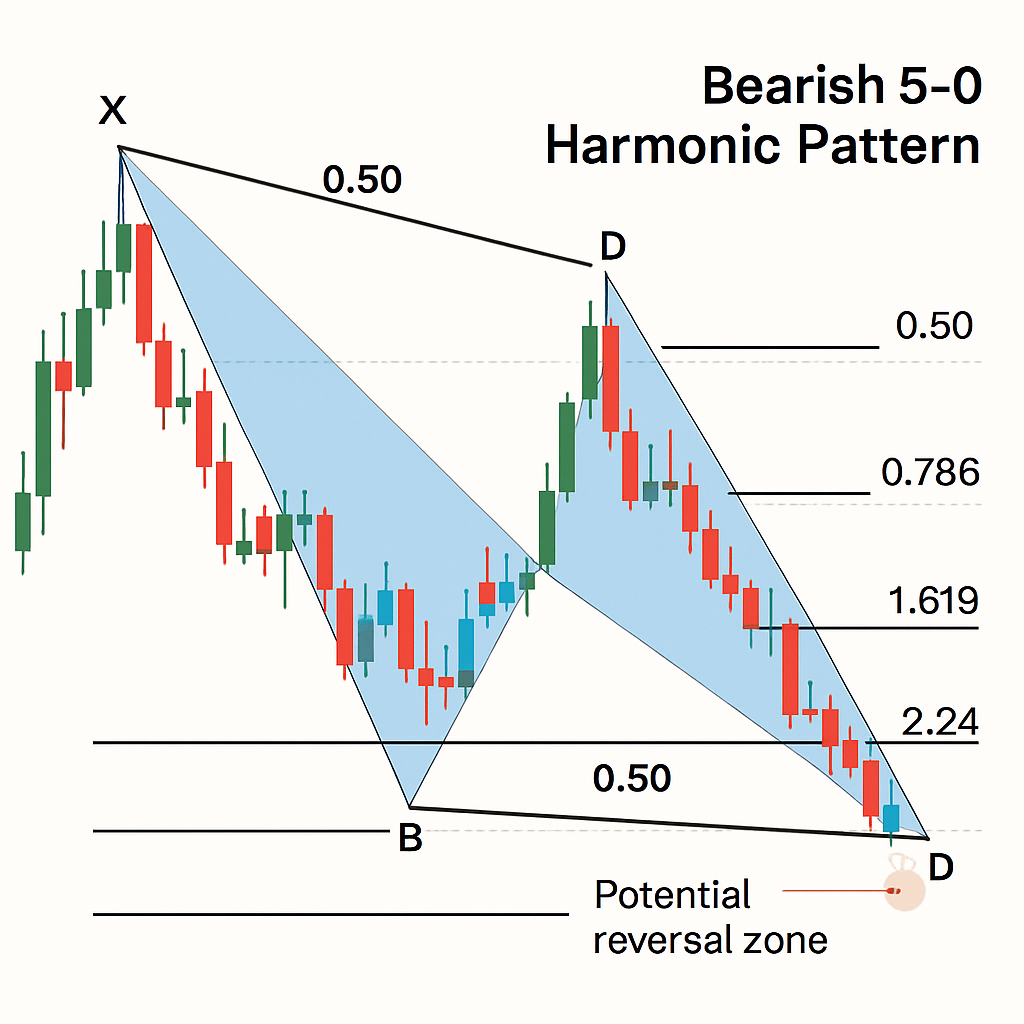

- Point B: A retracement of the XA leg, typically around 0.50 or 0.786.

- Point C: An extension of the AB leg, usually between 1.618 and 2.24.

- Point D (0 Point): The final point, which is a 0.50 retracement of the BC leg. This is the potential reversal zone.

How to identify the 5-0 Harmonic Pattern

Identifying the 5-0 Harmonic Pattern requires precise measurement of Fibonacci ratios. The pattern is valid when the following conditions are met:

- XA Leg: The initial impulse leg.

- AB Leg: Point B should retrace 0.50 or 0.786 of the XA leg.

- BC Leg: Point C should be an extension of the AB leg, typically between 1.618 and 2.24.

- CD Leg: Point D (the 0 point) must be a 0.50 retracement of the BC leg.

How to trade the 5-0 Harmonic Pattern

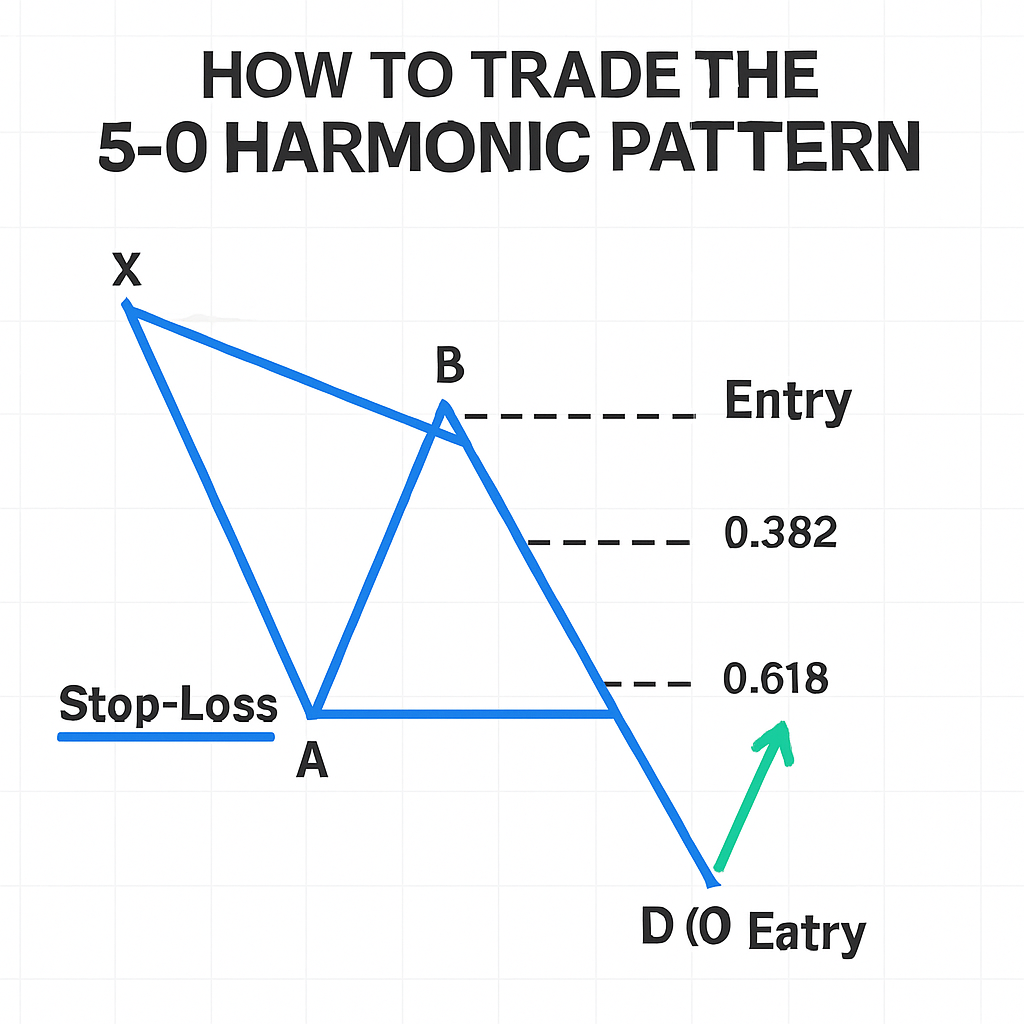

Trading the 5-0 Harmonic Pattern involves identifying the completion of the '0' point (Point D) and entering a trade in anticipation of a reversal.

- Entry: Enter a trade at or near the 0.50 retracement of the BC leg (Point D).

- Stop Loss: Place a stop loss beyond the X point for a bullish pattern, or beyond the C point for a bearish pattern, depending on the pattern's structure and market context.

- Take Profit: Target the 0.382 and 0.618 retracement levels of the CD leg, or previous swing highs/lows.

FAQ

Can you trade the 5-0 Harmonic Pattern by itself?

- No, the 5-0 Harmonic Pattern should be used in confluence with other trading concepts and indicators to confirm reversals and enhance your trading strategy.

Can you trade the 5-0 Harmonic Pattern in any market?

- Yes, the 5-0 Harmonic Pattern can be applied to various financial markets, including forex, stocks, commodities, and cryptocurrencies.

Can you trade the 5-0 Harmonic Pattern in any timeframe?

- Yes, the 5-0 Harmonic Pattern is fractal and can be identified and traded across different timeframes, from intraday to daily and weekly charts.