Cypher Harmonic Pattern Explained

What is the Cypher Harmonic Pattern?

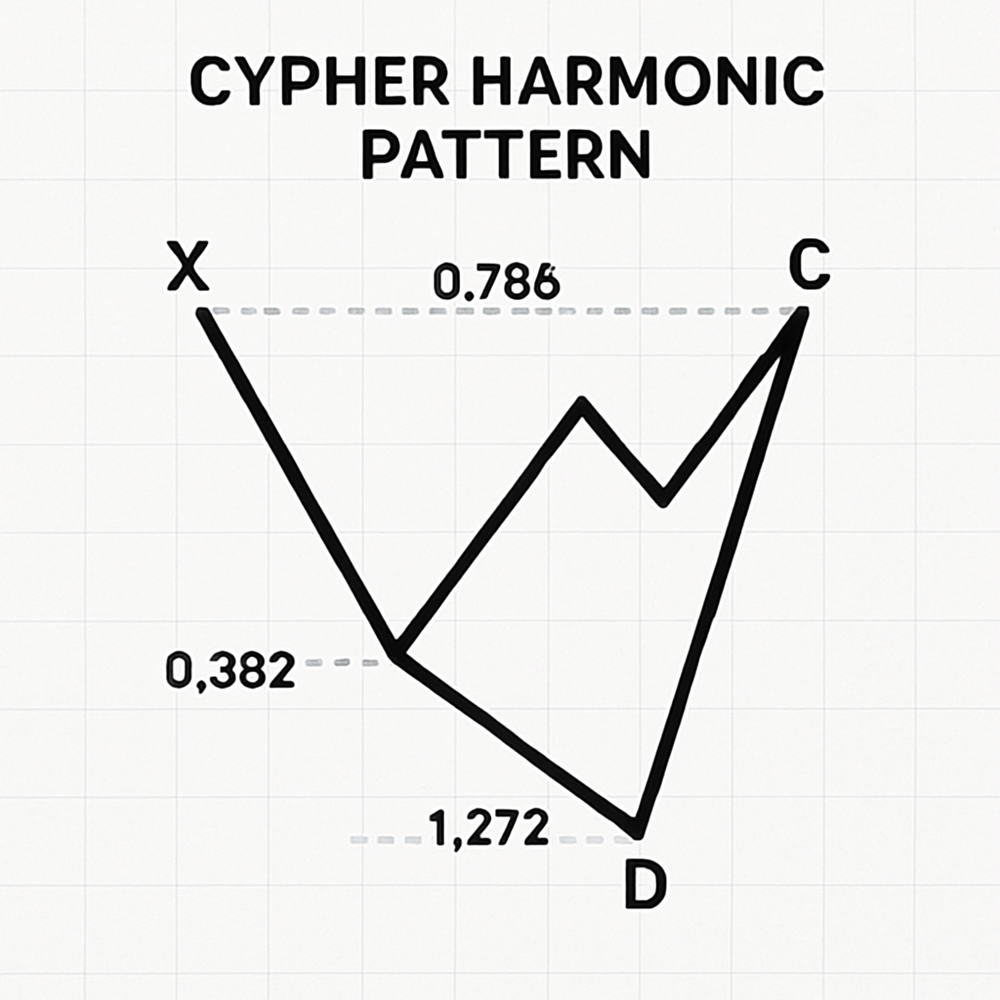

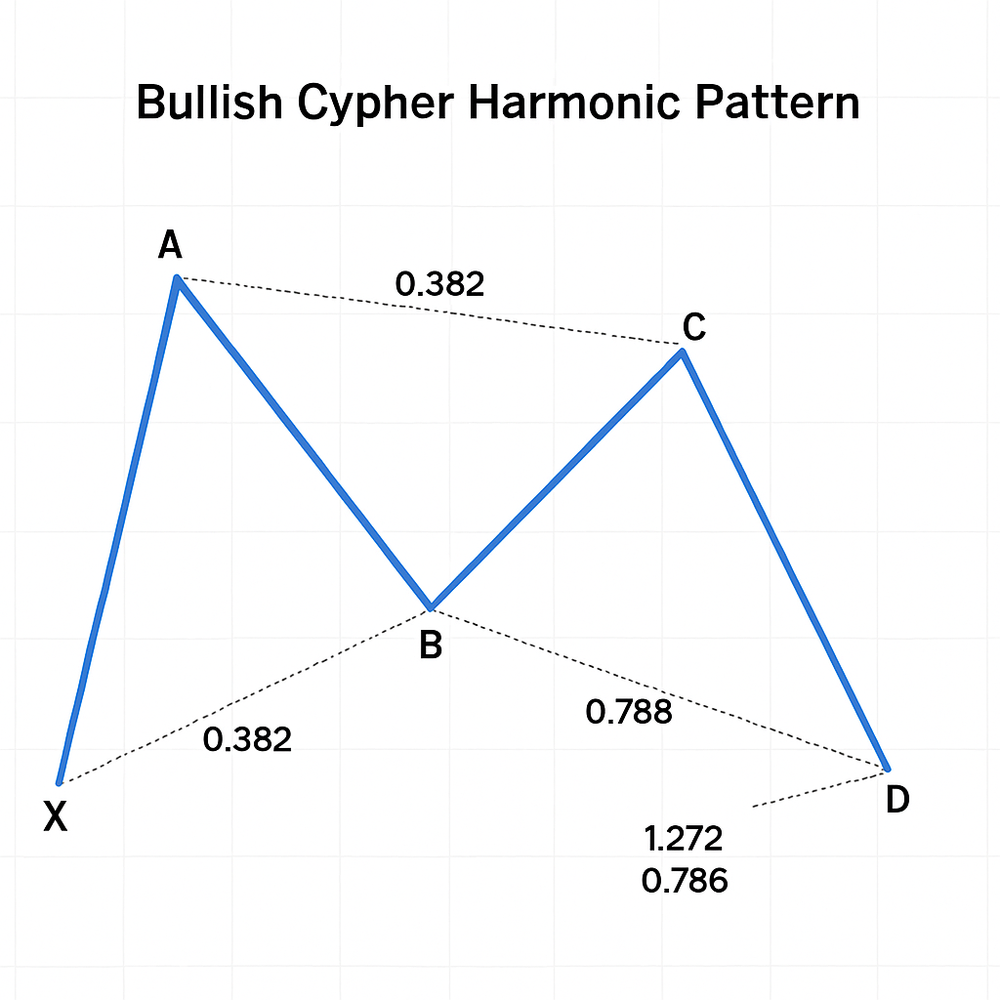

The Cypher Harmonic Pattern is a five-point reversal pattern that is an extension of the Butterfly pattern. It is characterized by specific Fibonacci ratios that define its structure, making it a precise tool for identifying potential trend reversals. The pattern consists of five points, labeled X, A, B, C, and D, each representing a significant swing high or low in price action. Understanding these points and their relationships is crucial for accurate identification and trading.

How to identify the Cypher Harmonic Pattern

Identifying the Cypher Harmonic Pattern involves precise measurement of Fibonacci ratios between the swing points. The pattern typically follows these rules:

- XA Leg: This is the initial impulse leg, which can be either bullish or bearish.

- AB Leg: The B point must retrace 0.382 to 0.618 of the XA leg. It cannot exceed the X point.

- BC Leg: The C point must be a 1.272 to 1.414 extension of the XA leg, and it cannot exceed the A point.

- CD Leg: The D point is the most critical. It must be a 0.786 retracement of the XC leg and a 1.272 to 2.000 extension of the BC leg. The D point should also be a 0.786 retracement of the XA leg.

Bullish Cypher Pattern

In a bullish Cypher pattern, the price forms a 'W' shape, indicating a potential reversal from a downtrend to an uptrend. The D point marks the potential reversal zone where traders look for long entry opportunities.

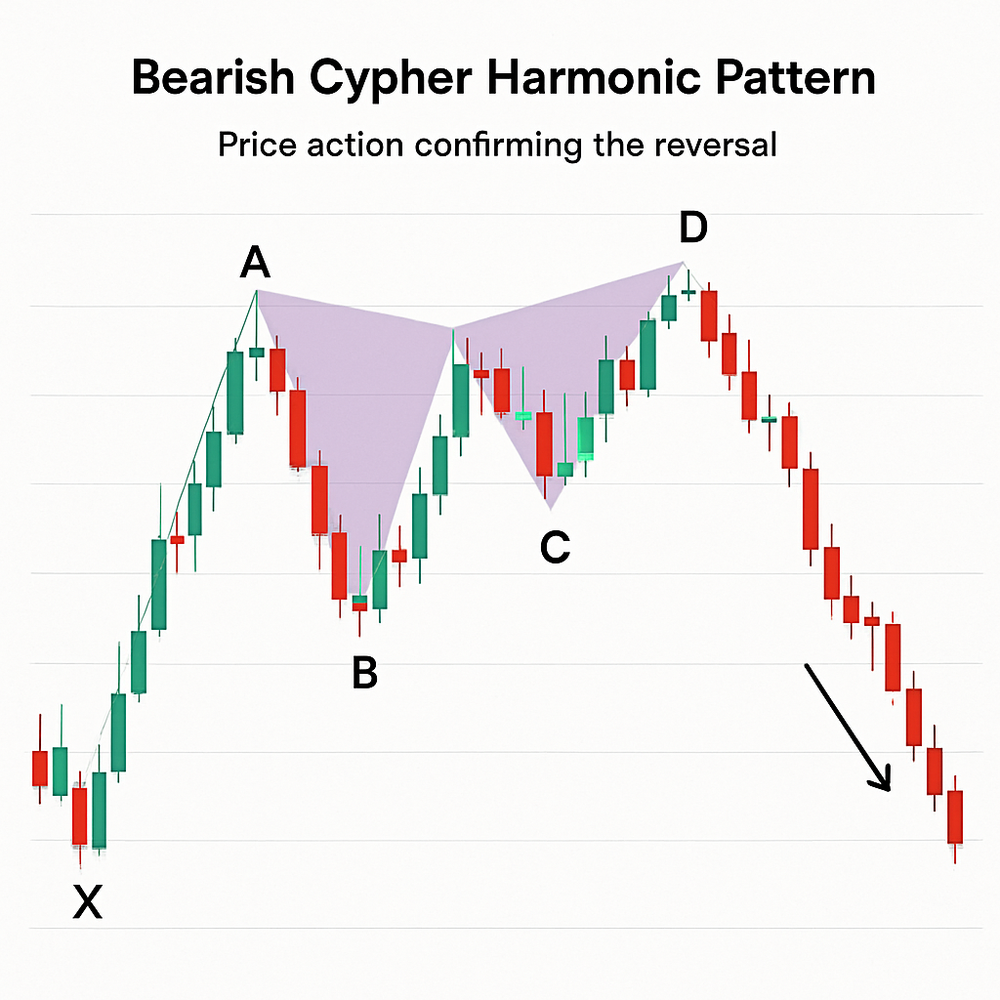

Bearish Cypher Pattern

Conversely, a bearish Cypher pattern forms an 'M' shape, signaling a potential reversal from an uptrend to a downtrend. The D point in this scenario is where traders anticipate short entry opportunities.

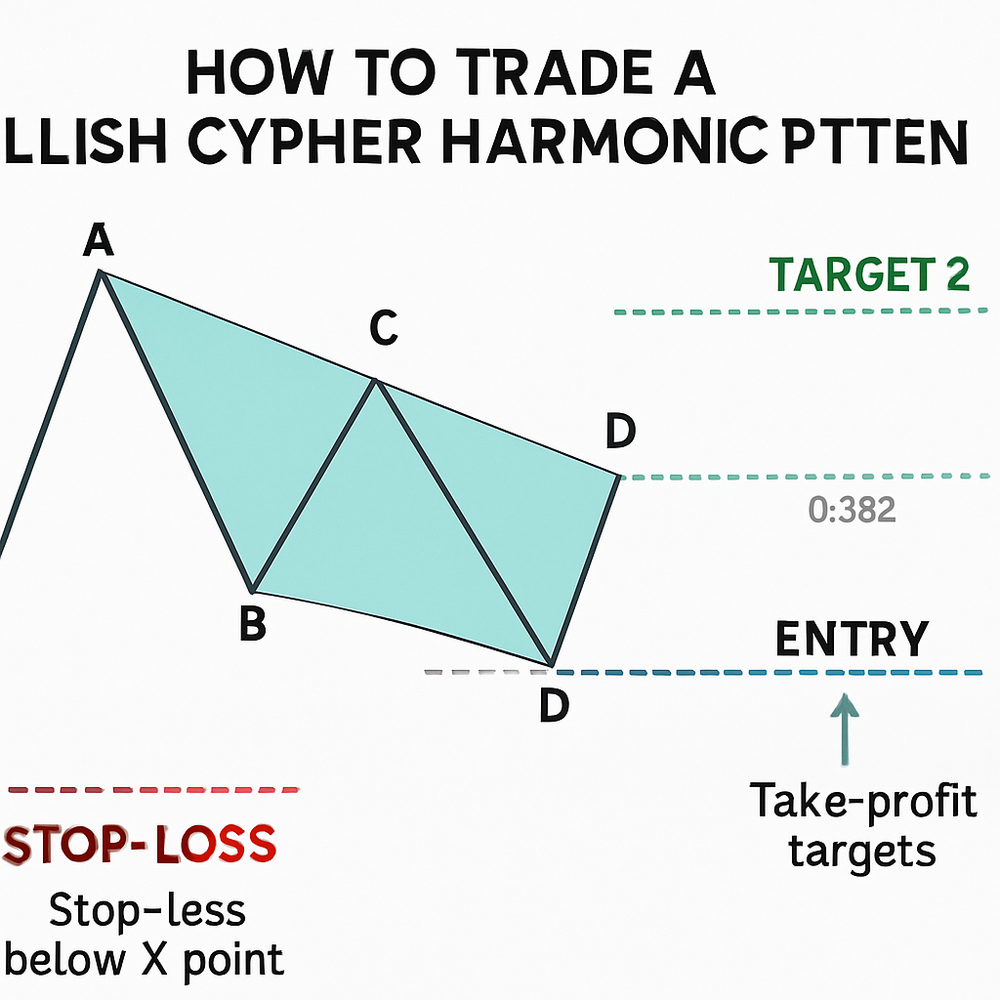

How to trade the Cypher Harmonic Pattern

Trading the Cypher Harmonic Pattern involves identifying the completion of the D leg, which serves as the potential reversal zone (PRZ). Here's a general approach:

- Entry: For a bullish Cypher, enter a long position at the completion of the D leg. For a bearish Cypher, enter a short position at the completion of the D leg. Confirmation from other indicators, such as candlestick patterns or divergence, can increase the probability of success.

- Stop-Loss: Place your stop-loss order strategically. For a bullish Cypher, a common practice is to place the stop-loss below the X point. For a bearish Cypher, place it above the X point. This helps manage risk and protect capital.

- Take-Profit Targets: Profit targets are typically set at various Fibonacci retracement levels of the AD leg. Common targets include the 0.382 and 0.618 retracement levels. Traders may choose to take partial profits at these levels and move their stop-loss to breakeven.

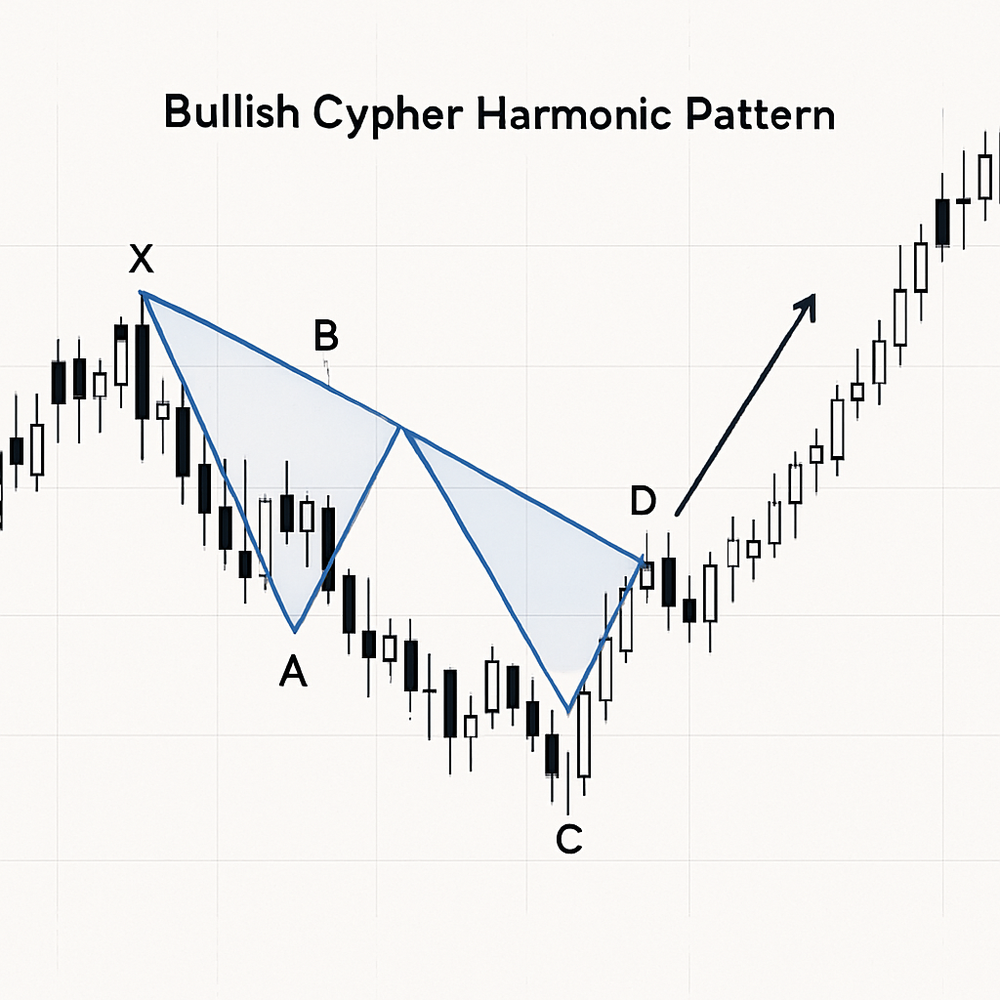

Example: Bullish Cypher Pattern in Action

Below is an example of a bullish Cypher pattern identified on a price chart. Notice how the price respects the Fibonacci ratios and reverses after completing the D leg, leading to an upward movement.

Example: Bearish Cypher Pattern in Action

Here is an example of a bearish Cypher pattern on a price chart. Observe how the price adheres to the Fibonacci ratios and reverses after the D leg, leading to a downward movement.

FAQ

Can you trade the Cypher Harmonic Pattern by itself?

- No, the Cypher Harmonic Pattern should be used in confluence with other trading concepts in your trading strategy for higher probability setups.

Can you trade the Cypher Harmonic Pattern in any market?

- Yes, harmonic patterns, including the Cypher, can be applied to various financial markets such as forex, stocks, commodities, and cryptocurrencies.

Can you trade the Cypher Harmonic Pattern in any timeframe?

- Yes, the Cypher Harmonic Pattern can be identified and traded across different timeframes, from intraday charts to daily or weekly charts.